03/27/2020

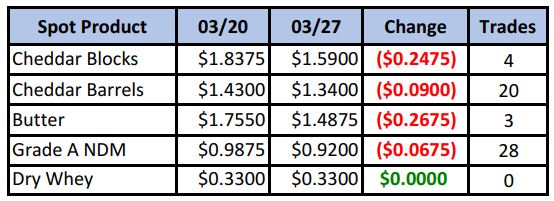

While there was pressure all week on spot butter and NDM prices, cheese managed to hang in there until Friday, when a good and proper puking was had. The block/barrel spread narrowed by 20¢, with both putting in 12-month lows. NDM prices haven’t been this low since 2018, but it was butter with the most sensational loss, hitting levels not seen since 2013 (see chart).

Spot Market Recap

Futures Recap

Block cheese was the big mover today, falling 15¢ in one session with no bidders in sight. Class III futures briefly traded limit 75¢ down May-August, before recovering some by day’s end. Butter futures were limit down yesterday, with a few contracts settling an expanded 10¢ limit down today. There was some advance warning as early as Monday with the release of the Cold Storage Report showing a strong jump in butter stocks. Inventories at the end of Feb were up 24% YoY. American cheese stocks on the other hand, were down 1% compared to last Feb, which was seen as price supportive.

At the end of the day though, none of that mattered as the spread of COVID-19 accelerated and fears grew over a longer-term economic slow-down.

It doesn’t matter that cheese demand in the EU is still very strong and that supplies are very limited.

It doesn’t matter that Australian milk output is down 5%, or that the drought in New Zealand is causing some farms to dry off cows two months early.

It doesn’t matter that fluid milk demand is “through the roof” and grocery stores are finding it difficult to restock.

COVID-19, this one, macro event, is THE market mover. We’re big enough to admit we’ve been wrong the past few weeks, not anticipating a collapse like we just witnessed. In fact, the demand shock of hoarding food staples we thought could actually cause a drop in fresh cheese supplies over the coming 30-45 days as milk was diverted to fluid/Class I use. We heard this week that some powder plants were completely without milk for days at a time. However, we’re also hearing that cheese orders have now slowed as analysis paralysis has most buyers on the sidelines, waiting to see what happens next. We were wrong about holding off on selling July-Dec and into 2021, as we’ve seen months way down the curve take deep dives on low volume.

We’re wrong, at least now, in the short term. Yet the tighter we stretch the rubber band, a violent move in the opposite direction becomes more and more likely. It was pointed out to us by a producer this week that even though they have DRP coverage on all of their production in Q2, they won’t get that money until July. In the meantime, they will need to cash flow on $13-14 milk, if prices hold where they are now. It will be a difficult stretch for many dairy operations in the same predicament.

But for now, what does matter is to stay safe and stay healthy. America is depending on our food producers like never before. Thank you for feeding our country.

As for hedging, producers with milk sold at much higher prices should continue to look at purchasing very cheap call options to cover upside risk. There are some great opportunities there. Give us a call so we can put together a plan that works for your operation and current positions.

Have a great weekend and stay safe!