01/17/2020

Barrel buyers pulled out their wallets this week, picking up 40 loads and raising the price 4¢, but blocks gained even more with only 2 loads exchanging, to widen the block/barrel spread to 40¢, just behind the record wide spread of 43¼¢ set just this past Sep.

Block/Barrel Spread

Meanwhile, NDM put in its highest price since Oct 2014, but butter fell to its lowest level since Oct 2016.

NDM & Butter

Dry whey also finished the week stronger, with active buying potentially indicating hog feed export needs are improving.

Spot Market Recap

Futures Recap

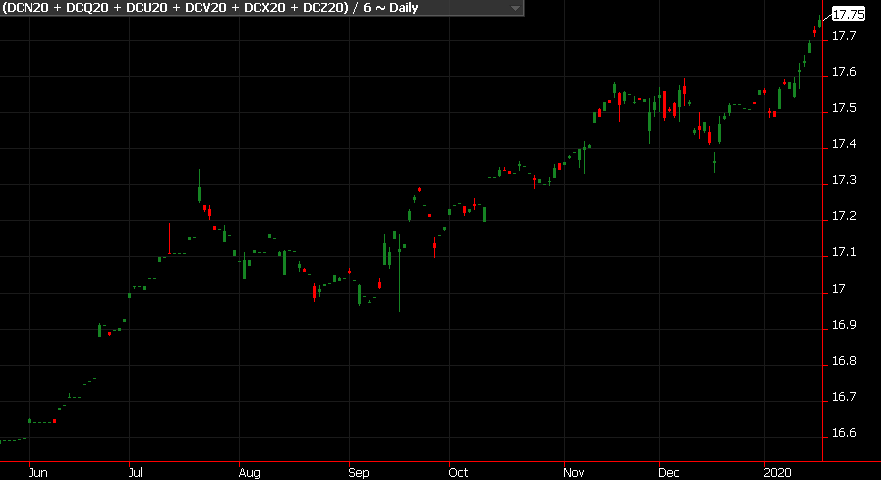

After being bruised the most by the correction following $20 this in the fall, the Q1 contracts of Feb and Mar have staged quite a comeback. This is one of those instances where near-term fundamentals are not lining up with price action. Milk production is improving across the country as we head in to the start of the flush period, with most cheese plants running full schedules. In addition, cream is abundant. One would think after just getting through the major holidays, lower prices would be in store, but that has not been the case. Indeed, the second half 2020 contracts are pushing in to NEW life-of-contract highs, settling at an average $17.75/cwt today.

July-Dec 2020 Class III Avg

With domestic fundamentals largely neutral to negative the market, we look to other factors to explain this week’s price strength. Reports from Australia are that 70,000 or more dairy cows have perished in their wildfires. EU milk production gains are stagnant. Trade deals have been signed. China’s hog herd is being aggressively rebuilt. The stock market continues to rock, improving consumer confidence.

This is one of those times that hedgers need to respect price action. With many contracts bouncing or making new highs, our advice is to stay out of the way. Switch to hedge strategies like PUT options or DRP that leave upside potential open.

Note: Our offices will be closed on Monday in observance of MLK Day. Markets will also be closed.

Have a great weekend!