12/06/2019

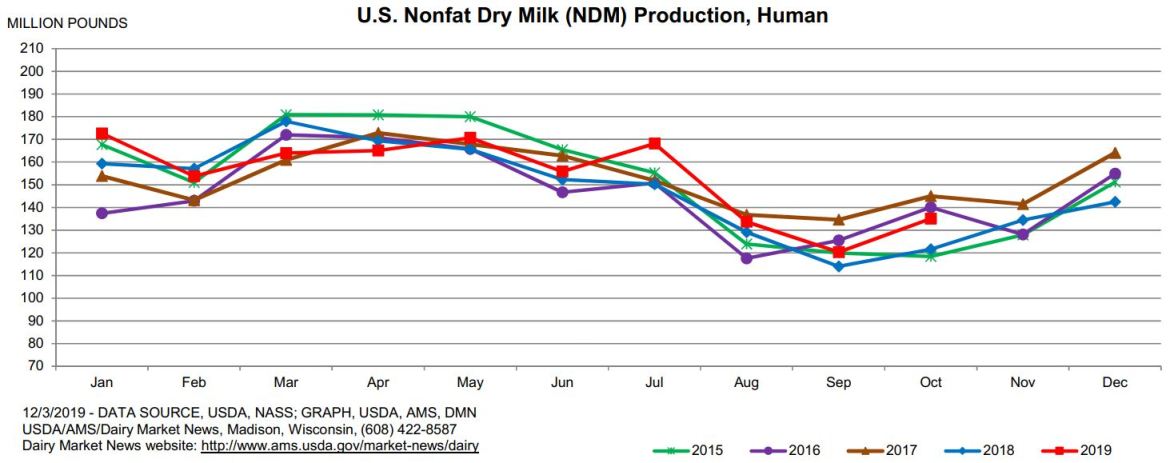

It’s not often you see spot dairy components put in new multi-year lows and highs int he same week, but that’s exactly what happened this first full week after Thanksgiving break. Spot butter fell to it’s lowest level since November 2016, but spot NDM reached new multi-year highs going back to October 2014 (see graphs below). Cheddar blocks seem to have found some stability in the upper $1.90’s while barrels continue to erode off recent highs. Finally, dry whey ground out a weekly gain, reaching levels going back to September.

Spot Butter

Spot NDM

Spot Market Recap

Futures Recap

Class III futures seemed to tread water at the beginning of the week, but after unfilled offers in the barrel market got a bit more aggressive, futures sold off hard on Thursday and were weak going in to Friday. The sell-off also coincided with an all-out sell recommendation the evening before by a somewhat prominent market analyst. Even at their highs, futures had been pricing in a significant discount. For example, January Class III, which starts pricing in just over a week, had a high settlement of $18.99 on 12/02, but cheese would need to drop to about about $1.90 average (both block and barrel) to get there. Today’s settlement of $18.62 is assuming an even lower drop, though Jan cheese futures settled at $1.93½/lb. If you’ve been active in the dairy markets for very long, you know prices can collapse quickly and far, so current Class III futures prices aren’t necessarily way off. But the current picture is murky. A lot of data has been released since Thanksgiving, so let’s get to it.

Dairy cow slaughter for the month of October was down 0.73% vs. last year. That marks two out of the last three months we’ve fallen below previous year levels.

The Cold Storage Report released this week was a mixed bag. Cheese output in October was down from last year. Cheddar cheese production declined 4.2% vs. 2018 while Total Cheese output fell 2.1%.

However, even though NDM output was higher, manufacturer’s stocks at the end of the month was down 13% YoY, helping explain the current strength in that market.

On the international side, this week’s GDT auction saw the dairy price index fall for the first time in 5 events, recording a 0.5% drop. Cheddar cheese, however, increased 2.7% to a U.S. equivalent $1.72/lb, still far below our domestic market.

The U.S. Dairy Export Council released their numbers this week. Record shipments of NDM and SMP to Asia as well as strong sales of cheese to Mexico helped keep dairy exports on par with last year and equaled 15.2% of total U.S. milk production during the month.

Fluid Milk output is starting to rise in more parts of the country, though balancing plants in the Mid-Atlantic and Southeast are not very active. Cream is abundant in the Midwest and West.

Domestically, cheese output during the holiday was somewhat muted in the East and Midwest, with some plants taking time off. Spot loads of milk in the Midwest were briefly discounted, but no longer. Cheese demand is good, with new holiday demand in some regions, but the West continues to have available supply.

With a heavy cream supply, butter churning is active throughout the country. Retailers are hoping the lower prices will spur additional demand for butter.

NDM prices are higher on strong export demand. Inventories are tightening. Dry whey prices were also higher this week, with a sudden jump catching some market participants off guard. Exports to Mexico and Asia are increasing.

In summary, the market broke this week on weakness in spot cheese, but may have overdone itself. That’s not to say we’re headed back up to $20 milk. Growing milk output and increasing cow numbers still have us recommending producers get coverage. But you may be able to get something done at higher prices. Q1 peaked in the $18.30 and settled today at $17.97. We would lock in prices anywhere from $18.14 average on up. Likewise, the first half average peaked at just under $18, but settled at $17.62 today. Consider selling at $17.74 or higher. The 2nd half of the year has not fallen much at all, settling at $17.53 average. We would make minimal sales in the 2nd half.

Expect more volatility and uncertainty next week. We honestly don’t know which way this thing swings in the near term. It could go either way.

Have a great weekend!